Login

Request a Demo

Login

Request a Demo

Do asset managers steward companies in their local markets the same as those abroad?

Institutional investors take varying approaches to global stewardship, some adopting a global benchmark, while others tune their approach through dedicated regional policies or employing a local stewardship team to adjust to local norms with “boots on the ground”.

In investors’ home market, anecdotal evidence indicates that asset managers pay particularly close attention to the performance and governance of companies. In Germany, local active investors like Deka and Universal Investments commonly make public remarks about German companies – Bayer, Adidas, and Siemens, to name a few - but refrain from doing so elsewhere. Similar behaviours are seen in other European and global markets.

This prompts us to question:

Do asset managers steward companies in their local market the same as those abroad?

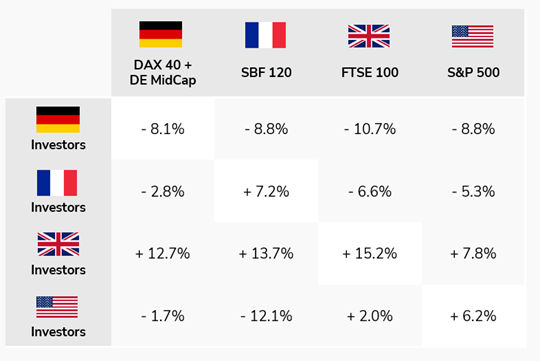

To answer this question, we used AQTION’s voting data statistics tool. Using the ReSearch function within the voting module, we can quickly access how particular investors vote on specific types of proposals in a given index over a defined timeframe. The table below showcases the output – the proportion of director election proposals supported by three of the largest investors from four countries across the main indices from those four countries, from January 2023 to December 2024.

From this foundation, we can then look at the relative differences in voting behaviours across the markets and take the average for each regional group of investors.

The voting statistics show that investors tend to be more supportive of director elections in their home market despite anecdotal evidence of public statements, which could be extrapolated to the depth of private engagement, creating an image of higher standards of accountability. The apparent inverse relationship may relate to sensitivities around the size of ownership and level of influence domestic investors have in their home markets, incentivising impact through dialogue rather than binary votes. Investors are also more likely to have relationships with local companies and other institutions (including governments), which could impact voting behaviours.

In addition, topics emerging from engagement may not always be aligned with reasons to vote against directors, especially when comparing active and passive investors, and the mandates of stewardship teams versus portfolio managers.

Votes can be misinterpreted, whereas direct engagement and understanding the expectations of institutional investors are key, regardless of a company’s origin or the location of its investors.

Please complete this form to receive our insight by email.

All fields are mandatory***

One of our team members will get back to you shortly with the details for the document